You may need help from a solicitor social services or a medical or care professional to set this up. This is true even for contracts that the attorney-in-fact signs on behalf of the principal.

Is Power Of Attorney Responsible For Nursing Home Bills Maybe

Ad Get Your Power of Attorney Today.

. What are the liabilities of being a power of attorney. Their website has useful factsheets and you can call them on 0800 169 2081. Please continue reading and reach out to our experienced Pennsylvania estate planning attorneys to learn more about the several powers of attorney and how we can help you create one.

The usual rule is that acts of the agent bind the principal. So while as a POA you dont need to pay the principals bills out of your own pocket you do have some important financial responsibilities. The executor of the estate is usually named by the will and is bound by its provisions.

When someone creates a power of attorney POA and names you as the agent sometimes also called attorney-in-fact you should not be held liable for that persons debts or other financial troubles unless those difficulties result from dishonest or grossly irresponsible acts on your part. Creating a limited durable power of attorney agreement is an excellent way to protect everyone involved from potential risk but there are other precautions you can take to avoid being accused of negligence fraud or outright theft. If you are given and except a Power of Attorney you become the agent of the grantor.

The term liability means facing possible legal consequences for personal conduct. A power of attorney document ends when your parents pass away. In that situation the administrator of the estate is the one.

For most adult children no one is ever. However if they become incapacitated you can use their assets to pay off their debt and not use your own money. Change your principals will.

Power of attorney is useful for making sure your loved ones are protected but there are certain things you dont have the authority to do. So if you have a power of attorney for your mother. Someone is still going to have to take care of their affairs after their death but it.

You cant get a power of attorney to act for someone after they have died and an existing power of attorney becomes invalid upon the death of the principalthe individual who gave you the right to take certain actions on their behalf. Before we get to that lets define a few terms. Up to 25 cash back Answer.

The service user has donated Lasting Power of Attorney to their son. Act in ways that are not in the principals best interest. But in this case would the agentLPoA not be liable for the unpaid charges given that they had.

Abuse of Power of Attorney. Once they become incapacitated youas the agentwill need to pay the debts using your parents assets and not your own money. One of the most important facets of any comprehensive estate plan is establishing a power of attorney.

The service users lacks capacity. Ad Create your free personalized Power of Attorney quickly and easily. Individuals who have acted improperly may be sued in civil court or even tried in criminal court depending on the nature of the conduct involved.

In this case the appellant argues his condition of attorney-in-fact of the company for the purposes of his non-liability in relation to the agreement of derivation of liability for the payment of the tax debts contracted by the aforementioned entity in application of article 401 of the General Tax Law. In addition you may have difficulty. When the principal dies the executor or administrator of an estate takes over to settle the estate.

As long as your parents are alive they are the ones responsible for the money they owe. Get Started Now on Any Device. Make decisions once the principal is deceased.

Through the POA you serve as an agent and fiduciary for the principal. You do need to be careful however. Print or Download a Free Power of Attorney Form.

First and foremost never commingle grantor assets with your personal assets. That role makes you responsible for properly managing their money assets and debts. After the expiration of a power of attorney the executor of the estate becomes responsible for legal and financial matters on behalf of the deceased principal.

As long as you are scrupulously honest. If youre the agent of your parents power of attorney youre not responsible for their debt. Power of attorney sole administrator.

When an agent. For example you cant. It is very important to understand that a power of attorney does NOT make the attorney-in-fact personally liable for the debts and obligations of the principal.

Problems of liability can blindside you and put you in a world of hurt. The agent is able to act only while the principal is alive. The parent had 3000 in credit card debt that the credit card company is pressuring the adult child.

During the period that the son held Power of Attorney the invoices were not paid. If youre a cosigner then yes you would be responsible but that has nothing to do with being a power of attorney. The person who wrote in to the chat has financial power of attorney and has had to move that parent into an assisted living facility.

A Durable Power of Attorney is a powerful document that allows an agent or attorney-in-fact to manage the financial affairs for another person called a principal. Browse Our Library of Legal Templates and Customize Your Legally Binding Documents Now. Are there different types of powers of attorney.

Essentially while a power of attorney represents a principal while they are alive the executor. A Live Chat with The Washington Posts Color of Money columnist Michelle Singletary posed an interesting question about handling a parents debt. Power of Attorney and Nursing Home Bills.

Ad Authorize Someone to Act on Your Behalf. The person who creates and provides you with the Power of Attorney is called the grantor principal or donor. If youre helping an older person deal with their debts Age UK can give you information about power of attorney.

No signing for your moms bills in the capacity of power of attorney absolutely does not make you liable for her debts. Create Legal Documents Using Our Clear Step-By-Step Process. In the unfortunate event that your parent passes away the existing power of attorney becomes invalid.

If your agent acts improperly in executing the duties set out under the power of. Durable powers of attorney are strictly construed by courts and agents should be mindful that they do not.

Don T Be Liable For Debt When Serving As Power Of Attorney Fox Business

Does Power Of Attorney Make You Responsible For Someone Else S Debts

Is Power Of Attorney Responsible For Nursing Home Bills Maybe

Can Power Of Attorney Help You Manage Your Parents Debts Ginsberg Gingras

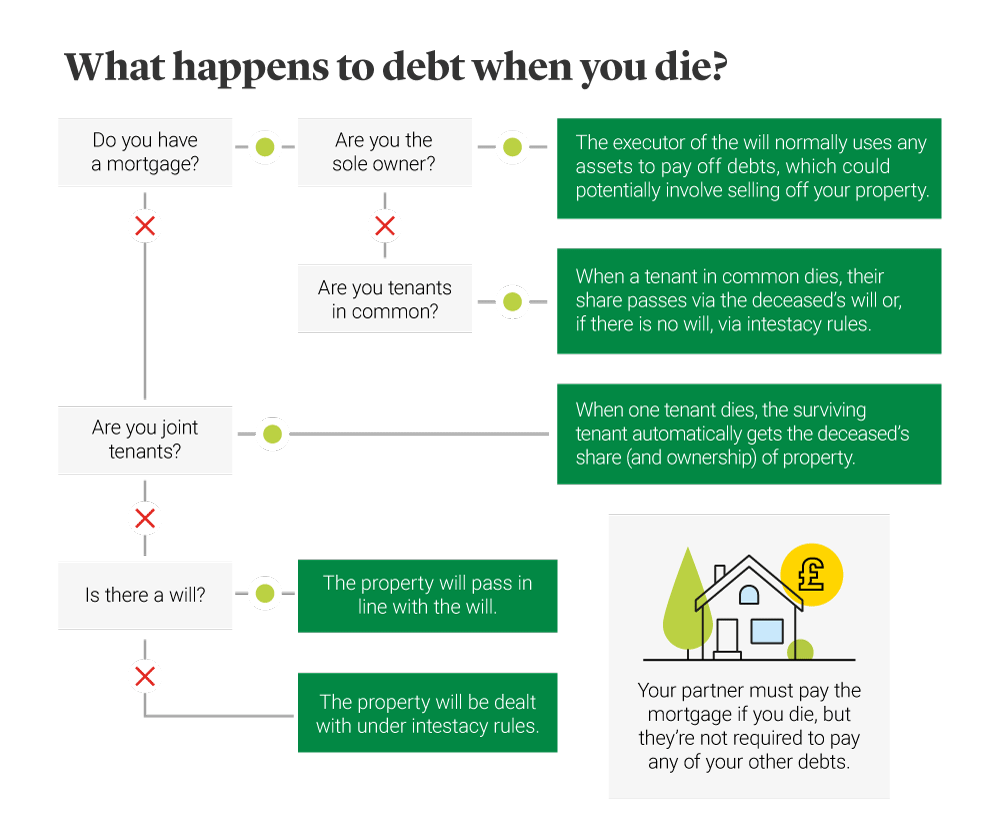

What Happens To Debt When You Die Legal General

Is Power Of Attorney Responsible For Nursing Home Bills Maybe

When You Are Born Living In The Private Birth Certificate Act For Kids Birth Records

Does Power Of Attorney Make You Responsible For Someone Else S Debts

0 comments

Post a Comment